Some of the app’s advertised features are only included with Rockey Money Premium.

The app helps locate and eliminate unwanted or old subscriptions.Rocket Money will negotiate bills on your behalf to cut your expenses.Rocket Money is great for individuals who want to save money on existing bills and monitor subscriptions.Premium membership gives you access to extra features like unlimited budgets, concierge services, premium chat support Who It’s Best For

Free personal budget app free#

Rocket Money is a free budgeting app that allows users to track spending, create budgets, automatically save money, negotiate bills, and monitor subscriptions.

Here are Family Money Adventure’s picks for the best budgeting apps for families. To determine the best budgeting apps for families in 2023, we looked at compared features, ease of use, availability, cost, app ratings, and other essentials so that you can make the best choice for your family.

Some budgeting apps will even negotiate monthly bills with your providers to lower your expenses and save more money every month.

Free personal budget app manual#

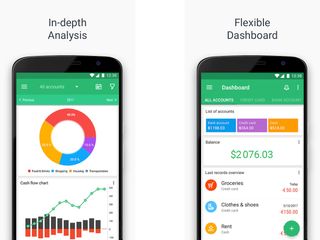

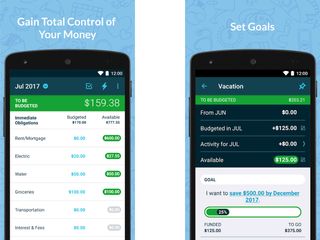

Some offer free trials as another way to test an app before paying for access.Įven if you like to manage your finances on your own, using a budgeting app in conjunction with manual budgeting can help you spot trends and target overspending and unwanted or long-forgotten subscriptions. Free budget apps are great to test drive before investing money in mobile money management. Some budgeting apps offer free and paid versions, allowing you to choose the best option. Many of the budgeting apps on our list still allow you to manually enter your information, but still, take what you input and analyze it to help you find gaps in your budget, examine spending habits, and ultimately improve your budgeting skills and save more money. If you’re not comfortable linking bank accounts to a mobile app, no problem. Instead of relying on an old notebook and pencil or a spreadsheet, budget apps offer automatic expense tracking and let you set and track savings goals. The best budgeting apps help your family track monthly income and expenses and give you access to your budget anywhere, at any time.

Free personal budget app full#

Please see my full disclosure policy for details. That means if you click and buy, I may receive a small commission (at zero cost to you).

0 kommentar(er)

0 kommentar(er)